Table of Contents

Nowadays it seems that you can earn a living in almost any way you can think of.

From new career paths online to being self-employed, flexibility is the name of the game.

But, if a vocation driving HGVs has captured your interest, you may well be wondering if it’s best to join a driving fleet as an employee or embrace the freedom and work for yourself.

So, what do you need to know about PAYE vs self-employed HGV driving to help you make a decision?

What is the difference between PAYE vs self-employed HGV driving?

It used to be the case that many more HGV drivers would set themselves up as self-employed, often as a Ltd company, and work with an agency to reduce the payout on things like tax and national insurance. This allowed them to keep more of the money they earned hour-by-hour.

However, with changes brought in by HMRC in April 2021, off-payroll working (known as IR35) or being self-employed can now be less attractive. This is because changes to IR35 now mean that self-employed drivers now pay broadly the same Income Tax and National Insurance as a PAYE employee would.

For this reason, it can be a much less attractive prospect.

As such, the main difference between PAYE vs self-employed HGV drivers is how they are employed.

PAYE

PAYE stands for ‘Pay As You Earn’ and allows your employer to deduct your income tax and NI contributions before they pay your wages.

To identify how much you pay, your tax code (a short series of numbers and letters) can be changed by HMRC each year based on how much you have earned and how much tax you have, or haven’t, paid.

Self-employed

If you are self-employed, however, you (or your accountant) will need to file your own self-assessment tax return, using bank statements and receipts from the year before the 5th of April.

Based on the report you submit, HMRC will then calculate your tax and NI contributions, which you need to pay by the following January.

For unscrupulous people, altering self-assessment tax returns is a way you can pay less tax and NI than you really should – something that the IR35 changes aim to resolve.

*Did you know we offer HGV finance to get you on the road quicker? Just another way the experts at HGV Training Network can help.

Benefits and considerations of PAYE vs self-employed HGV driving

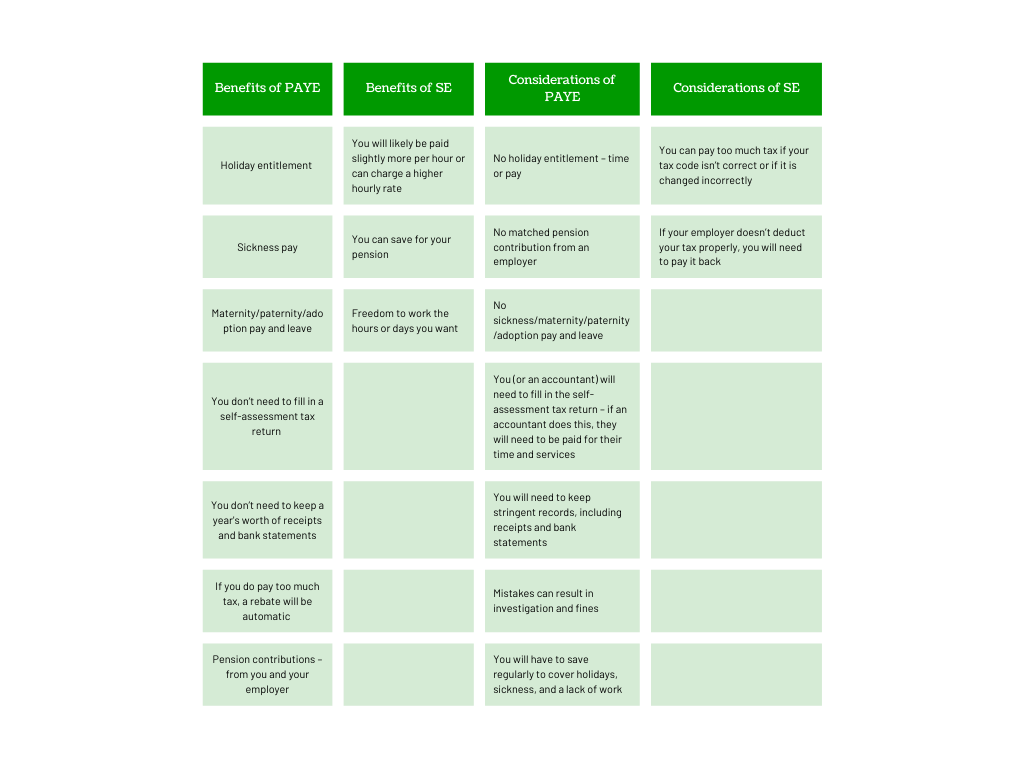

Our handy table discusses some of the pros and cons that are worth considering when thinking about your employment status:

Get your new career off the ground with HGVTN

Before you can start your career, however, if you haven’t already done so, you’ll need to retrain to be an HGV driver.

To get your HGV training started, why not reach out to speak to our experts? They have decades of experience driving the largest vehicles on our roads and can help with everything from setting up your medical to getting you through your theory and practical tests. To speak to us today, call us on 0800 254 5007 or fill in our contact form with some basic information about what you are looking for and we’ll get back to you as soon as we can.